Data Feed for Amibroker Secrets

Data Feed for Amibroker Secrets

Blog Article

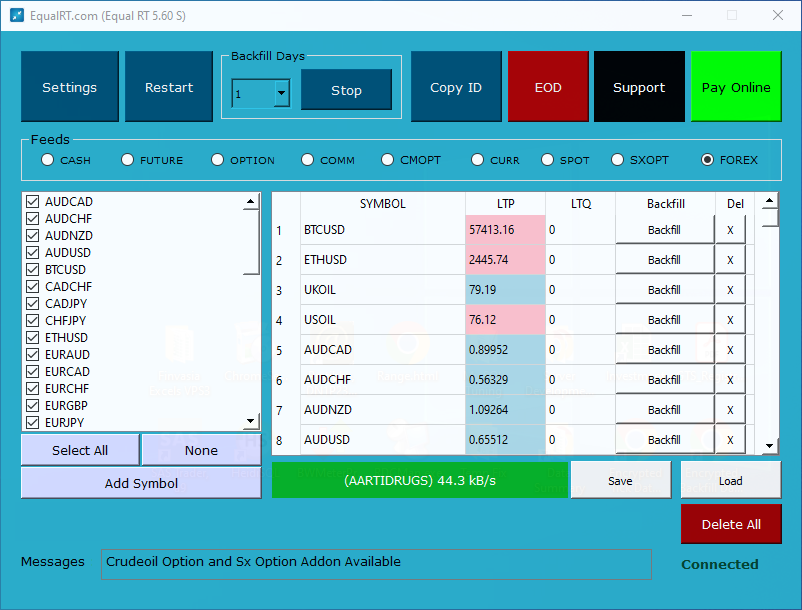

But regrettably, data doesn’t appear out of your box having an Amibroker membership, you need to subscribe data separately from 3rd party sources and plug it into Amibroker. In this article, we’ll look at the best Amibroker Datafeed solutions in India.

Other than the 3 Amibroker Datafeed Expert services detailed higher than, there are various Other individuals that we haven’t analyzed however but These are really worth possessing a check out:

This enables to get prices for many choices which have very extended symbols (exceeding 26 people allowed by AB).

Utilizing the above-mentioned AFL, chances are you'll opt for a script according to your needs and technological Investigation capabilities to trade out there.

We use cookies to make sure that we provde the finest knowledge on our Web site. If you go on to work with This website We're going to suppose that you are proud of it.OkPrivacy policy

Day/Night session instances as outlined higher than - daily data are made from your intraday bars that start off Initially time of night session (prior day) and stop at the tip time of working day session)

Please Observe that TWS API at present allows just one backfill at a time so when You will find a backfill presently running while in the background, automated backfill request for following symbol might be ignored, until eventually prior backfill is entire.

+ Main API pieces rewritten to implement rapid buffered sockets - offers upto 10x functionality enhancement (earlier versions utilized EClientSocket code equipped being a Portion of TWS API.

Accuracy of data – The datafeed should deliver precise data which can be utilized for live investing and also backtesting

Fibonacci Bands by Bollinger AFL compute the breakout amounts depending on stock volatility. It helps traders decide if the worth is higher than or underneath the acute marks.

+ IDEALPRO now employs MIDPRICE in lieu of BID to obtain cleaner backfill, but consumer can change again to BID in config monitor.

cleaning up negative ticks (if you see a foul tick you may attempt forcing backfill in hope that data click here vendor has cleaned up its database and you'll get fastened data - is effective well for eSignal that really appears to fix negative ticks once they come about)

Enable combined EOD/Intraday data - it lets to operate with database that includes a combination of intraday and EOD data in a single data file. If This really is turned on then in intraday modes EOD bars are eliminated on-the-fly and in day-to-day method EOD bars are shown in place of time compressed intraday or if there isn't a EOD bar for corresponding working day then intraday bars are compressed as regular.

Opens Time & Profits window that gives specifics of each individual bid, request and trade streaming from the marketplace.

+ IB API mistake information a hundred sixty five is made use of now to detect whenever backfill is available or not (demo account for instance doesn't provide backfill)